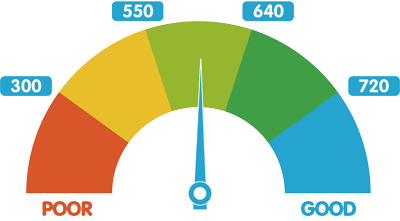

Credit Cards for Fair Credit

Do you have fair credit? Are you worried that you will not qualify for a credit card? Well, you can stop right there. It is easy to believe that there are no options if you currently have a fair credit rating. Fortunately for you, we are here to help. We can help you find and browse through the hundreds of credit cards that are designed for consumers like you, which have fair credit. The best thing about these credit cards is that they will provide you with a variety of benefits, which will help you improve your finances and best of all boost your credit rating. It can be a win-win situation. However, don't worry we will help you find the credit card that best suits your lifestyle. Our editors have compiled a list comparing the interest rates, fees, credit requirement and an overall review of the brand information. So let us help you secure the right credit card, at the right time.